When Everyone Points Fingers After a Car Accident

The moment after impact, everyone has their own version of what happened. Each driver believes the other caused the crash, passengers point fingers, and witnesses saw different things from different angles.

This confusion matters because fault determines everything: who pays medical bills, whose insurance rates increase, and whether you can recover any compensation at all.

In Texas, the stakes are especially high due to our “51% rule” that can completely bar your recovery if you’re found mostly responsible.

Insurance companies exploit this confusion with teams of investigators trained to shift blame onto accident victims.

They know that even small fault percentages can save them thousands of dollars.

Understanding how Texas determines fault helps you protect yourself from the moment the accident happens.

At Angel Reyes & Associates, we’ve spent over 30 years fighting these tactics to secure fair compensation for accident victims across Texas.

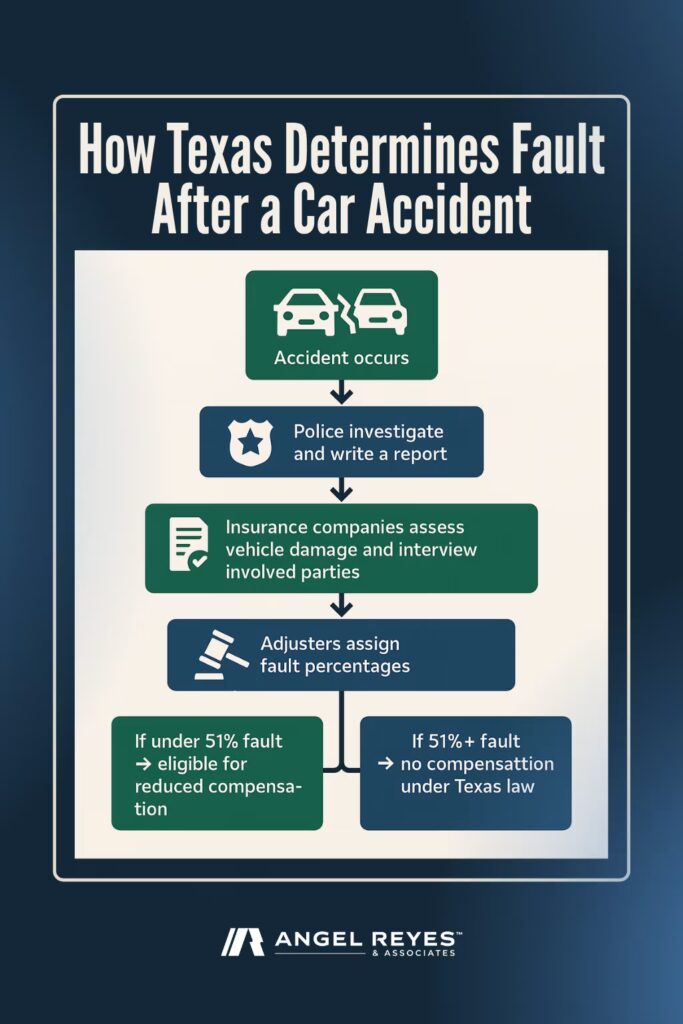

How Texas Law Determines Who Pays After Your Accident

Texas follows a modified comparative negligence system that’s different from many other states. This means you can still recover compensation even if you contributed to the accident—but there’s a crucial catch.

The magic number is 51%. If you’re found to be more than half responsible for the crash, you recover nothing from the other parties involved.

The 51% Bar Rule Explained

Think of fault like a pie chart divided between all drivers involved. As long as your slice is 50% or smaller, you can still pursue compensation.

Your recovery gets reduced by your percentage of fault. With $100,000 in damages and 20% fault, you’d recover $80,000.

But cross that 51% threshold and you lose everything. That’s why insurance companies fight so hard to push your fault percentage just a little bit higher.

How Fault Percentages Affect Your Settlement

Every percentage point matters when serious money is on the line. The difference between 45% and 55% fault could mean losing hundreds of thousands in compensation.

Insurance adjusters understand this math perfectly. They’ll argue you were speeding by 5 mph or following too closely—anything to nudge your fault percentage higher.

When Modified Comparative Negligence Helps You

This system actually protects drivers who made minor mistakes. Maybe you were changing the radio station but the other driver ran a red light—you might be 10% at fault while they’re 90% responsible.

Even partial fault doesn’t destroy your claim. Texas law recognizes that accidents rarely involve one perfect driver and one completely reckless driver.

The Evidence That Shapes Fault Decisions

Fault determination relies on multiple types of evidence, each telling part of the story. Insurance companies and courts piece together these fragments to assign responsibility percentages.

Police Reports and Traffic Citations

Officers arriving at accident scenes create the first official record of what happened. They interview drivers, examine the scene, and often issue citations that strongly influence fault determinations.

But police reports aren’t gospel. Officers sometimes miss crucial details or draw incorrect conclusions from limited information at chaotic accident scenes.

Citations create presumptions of fault that are hard to overcome. A ticket for running a red light or illegal turning makes fighting fault assignments much more difficult.

Vehicle Damage Patterns

Your car tells a story through its dents and scratches. Accident reconstruction experts read these damage patterns like a book, determining angles of impact and approximate speeds.

The physics don’t lie. Damage location reveals whether someone was changing lanes improperly or where vehicles first made contact.

Rear-end collision damage typically shows clear fault patterns. Side-impact damage from T-bone accidents helps establish who had the right of way.

Witness Statements and Video Evidence

Independent witnesses provide crucial neutral perspectives. Unlike involved drivers, they have no stake in the outcome and often see details drivers miss.

Video evidence has become increasingly important. Dash cams, security cameras, and traffic cameras capture accidents in real-time, eliminating conflicting stories about what happened.

Getting witness information immediately is critical. People disappear quickly after accidents, taking their valuable testimony with them.

Electronic Data from Modern Vehicles

Today’s vehicles are rolling computers that record everything. Event data recorders capture speed, braking, steering angle, and seatbelt use in the seconds before impact.

Cell phone records reveal distracted driving. GPS data shows exact speeds and locations that drivers might lie about.

This electronic evidence often surprises drivers who didn’t realize their own vehicle was documenting their actions. Insurance companies eagerly seek this data to support their fault arguments.

Common Fault Scenarios in Texas Crashes

Certain accident types create predictable fault patterns. Understanding these helps you anticipate insurance company arguments and protect your interests.

Rear-End Collision Responsibility

The trailing driver usually bears fault because they should maintain safe following distances. Texas law expects drivers to leave enough room to stop safely regardless of what happens ahead.

But automatic fault assumptions aren’t always correct. Sudden lane changes, brake-checking, or non-functioning brake lights can shift fault to the lead vehicle.

Intersection and T-Bone Accidents

Intersections create complex fault scenarios when drivers disagree about signal colors or right-of-way. These disputes often come down to witness testimony and physical evidence.

Even with a green light, you might share fault if you could have avoided the accident through defensive driving. Insurance companies love arguing you should have seen the other driver coming.

Left-Turn and Multi-Vehicle Crashes

Left-turning drivers face uphill fault battles since they must yield to oncoming traffic. But speeding straight-traveling drivers who make safe turns impossible can share responsibility.

Multi-vehicle accidents multiply the complexity. Three or four drivers might each bear different fault percentages based on their individual contributions to the chain of events.

Parking Lot and Low-Speed Collisions

Parking lots operate under different rules than public roads. Without clear right-of-way laws, fault often gets split between drivers.

These seemingly minor accidents still follow the same fault determination process. Low speeds don’t mean low stakes when injuries occur.

How Insurance Companies Manipulate Fault Against You

Insurance companies employ teams of professionals whose only job is minimizing claim payouts. They use sophisticated tactics to shift fault onto accident victims.

Recorded Statement Traps

That friendly adjuster calling to “just get your side of the story” is actually building a case against you. They ask carefully crafted questions designed to elicit damaging admissions.

“Were you running late?” seems innocent but establishes motive for speeding. “Could you have stopped sooner?” plants seeds of doubt about your defensive driving.

Understanding how insurance companies handle claims helps you recognize these manipulation tactics. Every word you say gets analyzed for ways to increase your fault percentage.

Early Settlement Pressure

Quick settlement offers come with strings attached. Buried in the paperwork are admissions of partial fault that become permanent once you sign.

Insurance companies know accident victims face mounting bills and financial pressure. They exploit this desperation with lowball offers that require accepting more fault than you deserve.

Social Media Monitoring

Your Instagram photos and Facebook posts become evidence in fault disputes. Insurance investigators comb through social media looking for anything to twist against you.

That photo of you at a party the week after the accident “proves” your injuries aren’t serious. Posts about being distracted or tired get interpreted as evidence you caused the crash.

Medical Opinion Shopping

Insurance companies send you to their chosen doctors who minimize injuries and find pre-existing conditions. These biased medical opinions support arguments that the accident wasn’t severe or didn’t cause your claimed injuries.

They’ll argue your back problems existed before the crash. Your headaches must be from stress, not the collision impact.

Protecting Your Rights During Fault Investigations

Smart actions immediately after an accident can prevent unfair fault assignments. Every decision you make affects the eventual fault determination.

What Never to Say at the Scene

“I’m sorry” becomes an admission of guilt in insurance company hands. Even expressing concern for the other driver gets twisted into accepting responsibility.

Stick to exchanging required information. Let investigators determine fault based on evidence, not emotional statements made in shock.

Evidence to Gather Immediately

Take photos before vehicles move—skid marks, traffic signals, weather conditions, and vehicle positions all matter. Insurance companies can’t dispute photographic evidence as easily as memory.

Get witness contact information immediately. Their fresh memories and neutral perspectives often determine fault disputes.

Document everything properly because evidence disappears quickly. Skid marks fade, witnesses leave, and memories become unreliable.

Medical Documentation Importance

Insurance companies pounce on treatment delays to argue injuries weren’t accident-related. Immediate medical attention creates an undeniable connection between the crash and your injuries.

Follow all treatment recommendations. Missing appointments or refusing prescribed care gets used as evidence that you’re exaggerating injuries.

Handling Insurance Communications

Every conversation with insurance representatives is a potential trap. They record calls and take detailed notes of everything you say.

Politely decline giving recorded statements without legal counsel. Direct them to communicate through your attorney once you have representation.

If you must speak with them, stick to basic facts. Don’t speculate about what you could have done differently or accept any blame.

When Fault Disputes Demand Legal Protection

Some situations are too complex or valuable to handle alone. Recognizing when you need professional help protects your rights and maximizes recovery.

High-Damage Cases Need Expertise

Serious injuries mean serious money at stake. The difference between 30% and 50% fault could cost you hundreds of thousands in medical bills and lost wages.

When to hire a car accident lawyer becomes obvious with major injuries. Professional representation typically recovers far more than it costs.

Complex Accident Reconstruction

Multi-vehicle crashes, commercial trucks, or unusual circumstances require expert analysis. Police reports often oversimplify complex accidents.

Professional accident reconstructionist use physics, engineering, and specialized software to determine what really happened. This expert testimony can completely change fault assignments.

Fighting Unfair Fault Assignments

Insurance companies sometimes make outrageous fault determinations hoping you’ll accept them. When their position has no basis in reality, legal intervention becomes essential.

Attorneys know how to challenge biased investigations and present evidence effectively. They understand which arguments work with insurance companies and juries.

Insurance Bad Faith Claims

Companies that deliberately manipulate evidence or make unreasonable fault assignments might face bad faith liability. This means additional damages beyond your actual losses.

Proving bad faith requires extensive knowledge of insurance regulations. These cases offer leverage to force fair fault determinations.

How Angel Reyes & Associates Maximizes Your Recovery

Thirty years of fighting Texas insurance companies taught us their every trick. We use this knowledge to protect clients and maximize compensation.

Independent Investigation Power

Insurance companies investigate to find fault with you. We investigate to find the truth and build your strongest case.

Our investigators work fast to preserve evidence and locate witnesses while memories stay fresh. We often uncover crucial evidence that insurance companies conveniently miss.

Strategic Communication Management

All insurance contact goes through our office once you hire us. This prevents accidental statements that damage your claim.

Adjusters know they can’t pressure or manipulate our clients. They have to deal with experienced attorneys who understand their tactics.

Expert Witness Resources

We maintain relationships with accident reconstruction experts, engineers, and medical professionals. These experts provide testimony that counters unfair fault assignments.

Juries understand complex accidents better when qualified experts explain the evidence. This testimony often determines verdict outcomes.

Fault Percentage Negotiation

Experience tells us when to push hard and when to accept reasonable compromises. We understand how small percentage differences create huge compensation impacts.

Every case is different, but patterns emerge after handling thousands of accidents. We know which arguments work and which waste time.

FAQs About Texas Car Accident Liability

Who pays if both drivers are partially at fault?

Each driver’s insurance pays based on fault percentages. With 30% fault, you’d recover 70% of your damages from the other driver’s insurance while they’d recover 70% of theirs from yours.

Can I still sue if I was partly at fault?

Yes, as long as you were 50% or less at fault. Your compensation reduces by your fault percentage, but partial fault claims remain valid under Texas law.

How long do I have to dispute fault in Texas?

The two-year statute of limitations applies, but earlier action preserves better evidence. Waiting makes proving your case much harder.

What if the other driver has no insurance?

Uninsured motorist accidents require filing with your own insurance. Fault determination still matters for your claim value.

Should I accept the insurance company’s fault determination?

Never accept unfair assignments without legal review. Initial determinations often change with proper legal representation.

Don’t Let Fault Disputes Cost You Fair Compensation

Fault determination shapes your entire financial recovery after an accident. Insurance companies know this and invest heavily in shifting blame onto victims.

Their teams of adjusters, investigators, and lawyers work against you from day one. Without equal firepower on your side, you’re fighting an unfair battle.

Angel Reyes & Associates levels the playing field with three decades of experience fighting these exact tactics. We know how insurance companies think because we’ve beaten them thousands of times.